Since the acquisition of Stern in March 2022, the Hedin Automotive Group has solidified its brand in the Netherlands. With 62 locations and over 20 brands, the Swedish family-owned company is represented throughout the country. It has become one of the major players in the automotive industry and holds a significant position in the European market.

“With such a vast number of locations, it’s crucial for us to continue making the right moves to maintain and strengthen our current position,” says Jacco Poldervaart, Director of Used Cars at Hedin Automotive NL. “Because the market is constantly evolving.”

“We’ve had two good years. During the COVID-19 pandemic, many manufacturers faced supply issues, resulting in fewer new cars available and increased demand for used cars. But now, new cars are being produced again. So we need to strategically respond to the opportunities and threats in the used car market.”

However, there are more developments in the new car market. Manufacturers are increasingly adopting the agency model, meaning they directly deliver their cars to consumers through importers. Previously, consumers used to order their cars through dealers who could set their own profit margins. Now, the dealer has become an agent who receives a delivery fee for their services. Brand dealers have less control over the sales of new cars, which is why Hedin Automotive chose to expand its used car operations.

To be able to quickly respond to these changes, having the right market information is crucial. Jacco: “We took the first steps years ago, by developing our own Power BI dashboard. But it’s a new day and as such, we had the ambition to take our data capabilities to the next level.”

This aligns well with Hedin Automotive’s vision for the future, aimed at growing their volumes and results. “This means that significant changes are needed in some stores, while small optimizations will suffice in others.” These decisions could be made based on intuition, but Hedin Automotive prefers to be guided by data.

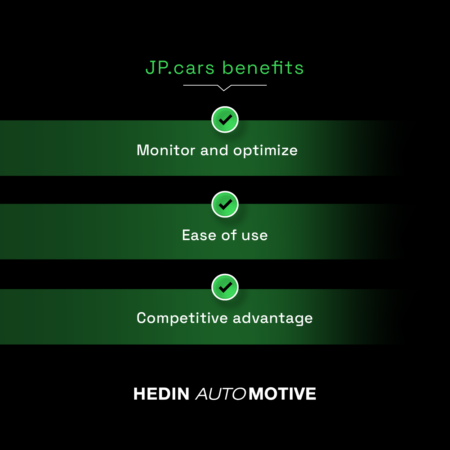

Last year, Hedin Automotive started looking for a partner who could help them with their data ambitions. After comparing various tools, they ultimately chose JP.cars. Partly because it allows Hedin Automotive to unlock relevant data for their own Power BI dashboard.

“But for me, ease of use is one of the most important factors,” says Jacco. “JP.cars allows me to quickly access the KPIs at a cluster or branch level. And it’s a great tool for the local sales teams to work with. Additionally, JP.cars is at the forefront of dynamic pricing, which gives us a competitive advantage in the occasion market.

“To try out the software, we started with one cluster of locations during the pilot phase and gradually expanded from there. This allowed us to see the added value of JP.cars. We’ve also had positive experiences with their support. They actively contribute to our strategy and provide innovative ideas we can implement.” JP.cars has been rolled out across all Dutch locations as of March 1, 2023.

Hedin Automotive primarily utilizes the software from JP.cars to monitor their inventory. Jacco and his colleagues can track which cars are being sold and determine the average time in stock. “Inventory turnover is an important KPI for us. Despite certain market developments, we see a positive trend in this area.”

“We partly owe this to the insights from JP.cars and the strategic recommendations they provide. Within the tool, we have established several company-specific protocols, which for example allow us to actively sell older cars first.”

Additionally, JP.cars is leveraged for dynamic pricing, meaning the sales price is adjusted daily according to the market. Jacco: “This means we engage in pricing activities on a daily basis. JP.cars is an excellent addition for us. The software scans the market every day and proposes a sales price. The brand specialist then decides whether or not to adjust the price based on the recommendation. This ensures that we are always aligned with the market and optimize our returns.”

Jacco also sees opportunities in purchasing. Because JP.cars doesn’t only provide pricing advice but also offers real-time insights into the marketability of cars. “This doesn’t mean we automatically overlook any slow-selling cars. It’s all about striking the right balance with the purchase

price. Ultimately, we can find a happy customer for every car, as long as we have a sufficient margin between the purchase and sales price. This matters for the long-term success of our company”, says Jacco.

Although the collaboration with JP.cars has only just started, Jacco can already see that Hedin Automotive is successfully keeping up with the market. A positive outlook. “Compared to the past two years, we’ve managed to grow our volume while keeping our margins at a minimum. That’s definitely a win-win for our company.”

As such, JP.cars will remain significant for Hedin Automotive’s growth in the future. “Hedin Mobility Group operates in many European countries, so it’s also interesting to explore how we can incorporate cross-border purchasing advice. JP.cars can help us connect international markets.”

With three branches and a studio in the heart of the city, Mobility Centre is the leading Volvo dealership in the greater Rotterdam area. In addition to supplying new models, the sales of used cars are increasingly important for Mobility Centre, which is why they have partnered with JP.cars for assistance.

Auto Hoogenboom is a household name in Rotterdam. Originating from this port city, the company – a subsidiary of Pon – has grown into a dynamic enterprise with approximately 400 employees.

D’Ieteren is a well-known name in the Belgian market and buyer for the Volkswagen Group. With their startup My Way, they target the used car business segment. These ambitious entrepreneurs are cleverly capitalizing on the changing landscape of the automotive market. To accelerate their growth, they’ve opted for JP.cars.

Since the acquisition of Stern in March 2022, the Hedin Automotive Group has solidified its brand in the Netherlands. With 62 locations and over 20 brands, the Swedish family-owned company is represented throughout the country. It has become one of the major players in the automotive industry and holds a significant position in the European […]

JP.cars works quickly, securely and simply for hundreds of cars at once.

‘We don’t have an automotive background, so we had a great deal to learn, and we’re still learning each and every day. Happily, our customers tell us they’re also learning from “our” data world because data is now an essential element of this capital-intensive and continually changing market.’ This is the observation of Jan-Willem Seeder, […]